Business Field

Enterprise-grade PaaS platform

Large Enterprise

High-Growth Enterprises

Small and Micro Enterprises

按钮![]()

Business Field

Tax Cloud

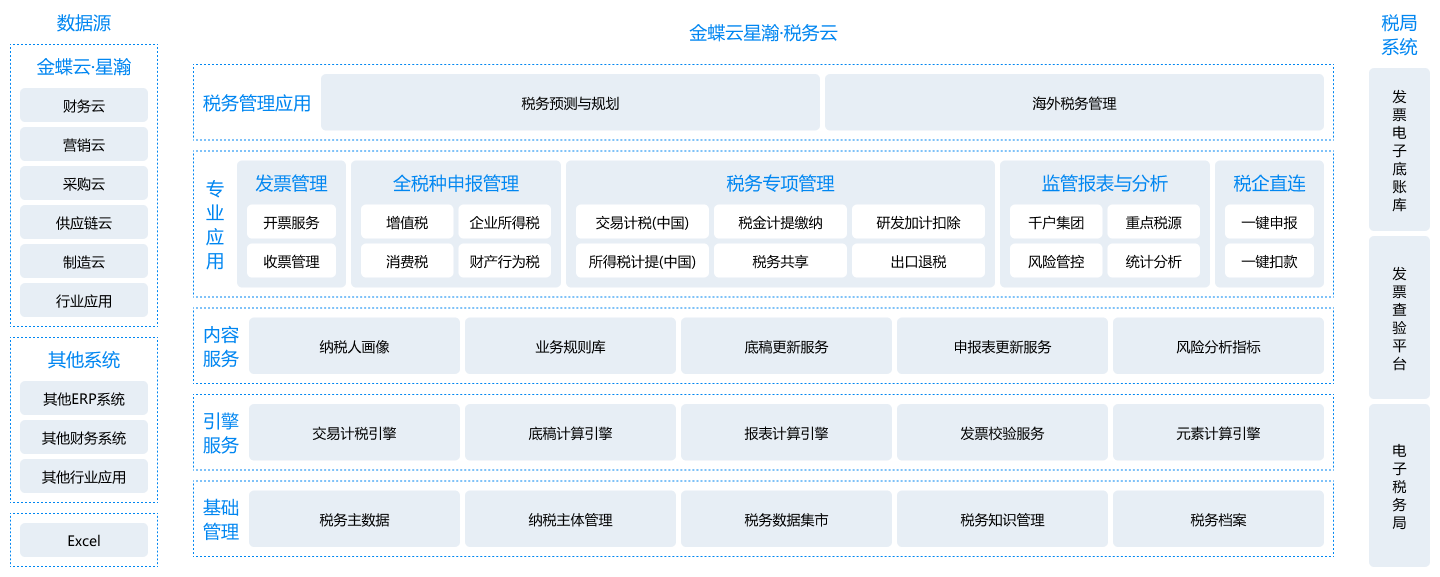

We integrated "business, finance, tax, tickets, capital, and files" to establish accurate and compliant digital tax control systems for enterprises.

Kingdee Constellation

Digital intelligent tax service platform

Kingdee Constellation Tax Cloud is a powerful solution that addresses multiple pain points and challenges faced by enterprises— it effectively resolves difficulties associated with tax-related data collection, complex tax filing preparation, limited understanding of tax risk control, data opacity, and absence of tax analysis models and tools, and significantly enhances the efficiency of tax teams and elevates the compliance level of enterprises.

Intelligent tax calculation

The platform includes a pre-set filing rule engine, content operation services, and supports automatic generation of over 5,000 tax scenarios, over 2,000 types of enterprises and over 100 types of filing reports.

One-click tax filing

Establish a direct connection channel between enterprises and taxation for seamless one-click filing, payment, voucher management, and monitoring of tax filing tasks, eliminating delayed filings and omissions.

Tax sharing

We leverage a task model to handle front-end tax work, centralize bill review and tax filing processes, enable tax sharing, and integrate tax knowledge management, tax file archiving, and other functions to enhance management quality and efficiency through standardization and improvement

Risk control

By implementing business-end invoice verification and finance-end automatic reconciliation, we ensure comprehensive control before, during, and after events. We incorporate Golden Tax Project III verification into the return process, and provide pre-set indicator models, and risk warning and processing functions.

Create an integrated intelligent taxation service platform for "industry, finance, taxation, tickets, capital, and files”

Kingdee Cloud Xinghan Tax Cloud seamlessly integrates tax-related data for enterprises, incorporates pre-sets risk models, and enhances the digital capability of tax management by integrating industry, finance, taxation, tickets, capital, and files. Additionally, we offer real-time tax content services, ensuring the returns are updated synchronously, enabling out-of-the-box intelligent tax calculation and one-click tax reporting, guaranteeing timely payments and maximum benefits for enterprises.

Core Business Scenarios

Invoice management

intelligent tax calculation

one-click tax filing

tax sharing

risk control

Integrated Invoicing for Sales Operations

Kingdee Constellation sales and receivables applications seamlessly integrate invoicing functions, provide a direct connection with the tax control system, and provide a blockchain electronic invoice platform for efficient issuance and printing of invoices. The invoice cloud service provides the flexibility to integrate with diverse heterogeneous systems through an API.

- Enable workflow approval, compatible with both centralized and decentralized management requirements.

- Implement intelligent tax classification code matching and facilitate merging and splitting functions.

- Streamline invoicing without external software, accommodating both individual and bulk invoicing situations.

- Invoice data reverse business documents in real time.

Intelligent multi-dimensional invoice compliance verification.

Utilizing OCR technology, we enable the capturing of invoice information through photos, identify invoice types, and automatically check their authenticity. Our system conducts checks for duplicate reimbursement, validates electronic invoice source documents, verifies invoice headers against current enterprise names, verifies invoice numbers, determines consecutive invoice sequences, performs seal check, validates tax number compliance checks, conducts blacklist checks, and provides personal invoice warning among other functions.

- Automate invoice image distribution, verify invoice information automatically, and provide hierarchical verification prompts.

- Enhance VAT comprehensive ticket information acquisition, automatic tax calculation, automatic price, and tax separation.

- Enhance old supervision seal identification and overdue invoice warning.

Implement full-process closed-loop control for all types of input tax

The input account accommodates a wide range of electronic invoices encompassing tolls, VAT invoices, customs payment letters, and passenger transportation records, among others. To enhance the usability of the system, we offer an input invoice analysis table and provide various report formats and personalized control options, catering to the unique needs of each user.

- Our system establishes a direct connection to the tax bureau's Golden Tax Project III verification platform, enabling seamless integration. This integration empowers our system to efficiently handle invoice invalidation, special red-letter invoice warning and red-letter invoice offset warning.

- The system interfaces with both business and financial systems, automatically generates vouchers, and automatically returns accounting voucher accounts and voucher numbers thereby streamlining the accounting process.

In-depth integration of invoices and business

The system interfaces between the purchase order and invoice data, invoice logistics, etc. of the SRM system and accounts payable and other business systems, automatically checks and matches the three documents, automatically generates accounts payable documents and vouchers, and promotes automation of accounts payable audit process.

- Support multi-channel collection via mobile terminal, PC terminal, scanner, and scanning guns.

- Integrate with accounts payable and expense report processes to promote business efficiency.

- Support in-depth integration with OA and imaging systems.

- Data discrepancy alerts, invoice and business document correlation query.

Shared control of filing items and unified group tax compliance caliber

Users can access comprehensive tax filing services, including the full amount of all tax filing items and the maintenance of the number of fetched items. This includes income, tax, and accounting differences adjustment items, tax benefits, and more. Our system also supports a shared control mode for group enterprises, facilitating unified internal tax compliance and reduces tax risks across the organization.

- Shared filing maintenance

- Customized shared solutions

Tax calculation: Preset industry-wide tax templates, ready-to-use anytime

Users can automatically generate tax calculation documents for all tax types and calculate current tax, taking into account the latest tax policies and calculation logic. The document data is both traceable and can be searched, and it aligns with the filing items and tax-related data of enterprises. The system comprehensively enhances the automation level of enterprise tax management, significantly improves efficiency, and reduce the tax risks caused by human errors.

- Enhance the taxation engine to self-adapt to the latest tax policies.

- Provide a library of preset tax documents that are readily available for immediate use.

- Support the comprehensive analysis and evaluation of joint investigation of tax document data through advanced data penetration techniques.

- Integration of finance and taxation systems to enable streamlined processing of tax accounts with a one-click completion feature.

Streamlined tax filing with adaptive compliance to current policies.

Enterprises can independently complete data collection, tax calculation, and tax return generation for each tax type. The system automatically adapts and fills out tax returns using the document data, incorporating the Golden Tax Project III verification rules. Customized risk warning items included in the returns assist enterprises to promptly identify any tax risks.

- Tax returns and algorithms are dynamically self-adapted to align with the latest tax policies.

- Automatic filing algorithm covers all types of taxes across various industries.

- Modification of record specification mark.

- Real-time risk warning for the filing process.

Retrospective joint investigation of complex tax data, including historical filing data.

Support retrospective joint investigation of the full amount of comprehensive tax information from historical filing data, including tax identity and qualification information, complete filing data, numbering rules, tax calculation drafts, and filing form. This enables traceability of the filing data from a single source and helps enterprises mitigate tax risks associated with improper connection of personnel flow.

- Comprehensive encapsulation of filing data for each period.

- Support comprehensive and in-depth retrospective joint investigations, enabling thorough analysis and examination of relevant data and information across different periods and sources.

One-click filing: automated batch filing.

The system supports one-click reporting of filing data to the tax office, significantly enhancing efficiency and eliminating manual errors associated with the reporting process.

- One-click batch filing.

- Verify the consistency of the reported data with the tax data.

One-click payment: automatic batch payment.

Enable direct connection with the tax bureau, facilitate one-click tax payment, and enhance work efficiency by streamlining the tax payment process.

- Enable one-click batch payments for streamlined processing of multiple tax payments in a single action, enhancing efficiency.

- Verify the consistency between payment data and tax bureau data.

Tax return voucher management: Voucher download, management, and archiving.

Enhance attachment management for tax return vouchers, official filing forms, filing records, payment records, and other tax return vouchers to meet the needs of audit and tax inspection requirements.

- Facilitate one-click download of diverse tax return vouchers directly from the tax bureau.

- Support uploading of attachments and keeping files for reference.

Comprehensive tax filing task monitoring: oversee tax filing tasks from all angles.

Thorough monitoring and tracking of one-click reporting and payment.

- Supports progress view of tax filing tasks.

- Supports viewing detailed logs of tax filing results.

Tax workbench: Provide a clear overview of tax tasks for thousands of people at a glance.

The tax work is hierarchically managed based on complexity, with different roles assigned to different tax subjects and tax returns for standardized and process-oriented operations. Users logging into the tax workbench can exclusively access information related to their own work, minimizing interference, improving efficiency and mitigating risks of misstatement and omission.

- One-click batch filing.Personalized Configuration Task Cards: Transitioning from "Unified Interface" to "Personalized Workbench."

- Information Sharing: Transitioning from "Decentralized" to "Centralized."

- Business Management: Transitioning from "Rough" to "Fine."

Multi-dimensional tax analysis: Visual Kanban for efficient problem-solving by identifying key contradictions.

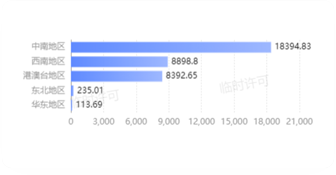

Leverage the underlying data center, embedded multi-dimensional analysis engine, in-depth tax data extraction, and personalized chart displays to swiftly grasp tax dynamics and outcomes.

- Analysis of management areas, industries, and business segments

- Visualization charts: Coverage area distribution, tax distribution, trend analysis, and more.

- Interrelated dimensions enable immediate tax issue discovery.

Group Cockpit: Tax trends, global control

Comprehensive group tax understanding: Analyzing from the big picture, delving deeper, traceability analysis, and effective monitoring.

- Tax maps: Simplifying tax distribution visualization.

- Multi-angle tax analysis Empowering agile strategic decision-making.

- Seamless switching: Instant tax-related insight at your fingertips.

Indicator early warning: Continuous monitoring of key indicators.

To enhance the enterprise's monitoring of key indicators, the system can generate pre-alerts and discover risks in time, as well as find the source of abnormal key indicators. Additionally, it can provide prompt warnings, discover risks, and find the source of abnormality in case of abnormal indicators.

- Customized key risk indicators

- Visual display of indicator results.

- Indicator trends are clear at a glance, facilitating risk analysis.

Risk search: Automatic scanning of abnormal data.

Support enterprises in conducting internal spot checks and self-inspections on key business data and promptly identify problem data sources.

- User-defined sampling inspection range and sampling conditions.

- Visualized centralized display of spot check problem data.

Consistency check: Multi-scenario comparison, automatic matching risk of inconsistent data.

A comprehensive data monitoring and validation system can be implemented to assist enterprises in checking key data and providing early warnings in case of inconsistencies.

- Custom check items

- Visual display of check results.

Credit level query: Gain insight into the credit situation of the enterprise and swiftly identify credit crises.

Support the query of tax credit grades and provide functions such as one-click query of downgrade status and visual kanban, enabling enterprises to discover credit crisis and deploy in advance to avoid relevant tax risks.

- Easy query of group credit rating.

- One-click query of relegated organizations

500+companies of the Group realized automatic tax calculation, and the filing efficiency improved by 94% on average.

With the help of Kingdee Cloud and Xinghan, ENN Group realized centralized management of tax-related data of 1,000+subsidiaries and realized automatic tax calculation for 500+companies of the Group. As a result of implementing these advanced solutions, the filing efficiency saw a remarkable improvement, with an average increase of 94%.

FAQ

"The administration of tax by numbers" refers to the digital upgrade and intelligent transformation of tax collection and management system in the era of digital economy. In March 2021, the Opinions on Further Deepening the Reform of Tax Collection and Administration outlined the goal of achieving a shift from "management of tax by tickets" to "management of tax by numbers" through classification and precise supervision by 2022. The transformation and upgrade of the tax collection and management system have had a direct impact on the tax management capabilities of taxpayers across industries. With enterprise data being transparent to the tax bureau, any abnormal change of accounting and tax data can be deducted by the tax bureau’s big data analysis model, potentially leading to taxpayer audits. As a result, there is an urgent need for digital transformation in enterprise tax management!

In the past, enterprises had dedicated teams for tax management, where invoices were sorted and tax filing forms were prepared after business and financial processing were completed. This approach often led to delayed tax processing, resulting in a heavy workload towards the end of each month. Real-time control of invoice tax risks became challenging, significantly impeding the development of enterprises. However, in recent years, there have been remarkable advancements in the tax bureau system, OCR identification technology, direct connection between tax authorities and enterprises, as well as between banks and enterprises. Additionally, development in electronic archives and other technical aspects have eliminated obstacles in real-time correlation, verification, and filing between invoice data and tax data, business data, financial data, and payment and settlement data. Kingdee Cloud·Xinghan has taken the initiative to integrate with the tax bureau as a whole and establish interfaces with various banks. Several clients, including Zhejiang Communications Investment Co., Ltd. New Austria, Hisense and other enterprise groups have successfully implemented the industry-finance-tax and document integration scheme. These advancements have paved the way for seamless integration and synchronization between tax-related data and other crucial business and financial information, enabling enterprises to operate more efficiently and effectively.

A consulting company brings a significant advantage by offering a standardized methodology that aids enterprises in devising a digital transformation system and charting a clear path. However, implementing this consulting scheme might pose challenges due to the complexities of internal management processes of large enterprises. Whether the consulting scheme can be fully implemented is a possible risk. To address this, it becomes imperative to engage in direct communication with consultants, enabling comprehensive evaluations and on-site discussions. By adopting a phased approach, the comprehensive planning of tax digitization transformation can be successfully accomplished. The stages encompass overall planning of tax digitization transformation covering the overall planning of invoice and value-added tax management, industry-finance-tax integration, full-tax filing management, risk control, and tax preparation. Through this methodical process, the enterprise can efficiently navigate the complexities and successfully undertake its digital transformation journey.

Throughout the entire process of business management, there is a need for comprehensive internal control and risk control systems. These systems encompass proactive risk avoidance measures, effective risk management during events, and strategies for addressing risks post-event. Even in the absence of systems, these tasks should be undertaken, allowing for the accumulation of experiences and identification of pain points. As an essential input for system development, these insights help in the purposeful construction of systems with minimal effort. In cases where risk control measures are not established prior to system installation and the analysis is incomplete, it becomes crucial to evaluate risk management requirements during or after the system is built. This necessitates a highly adaptable system capable of facilitating flexible changes. Xinghan Tax Cloud offers seamless coordination with enterprise management and provides essential functionalities such as invoice management, tax calculation, basic tax filing. With its risk control capabilities, the system can be leveraged to meet regulatory requirements and enable on-demand risk management applications.

文本内容

Contact Us

(65) 9856 0336

About Kingdee

Legal statement and privacy policy

Investor Relations

© 2024 Kingdee International Software Group Co., Ltd. all rights reserved.

Reject![]()

Agree![]()

We will use cookies to personalize your experience of using our website. You can click the 'agree to all' button on the right, which will be deemed as your agreement to the use of all relevant cookies.